CAC – Customer Acquisition Cost

(CAC) Customer Acquisition Cost is the cost associated with convincing a potential customer to buy a product or service from your business. It’s essentially the price you pay to acquire a new customer. In simpler terms, if you spent $1,000 on marketing in a month and acquired 10 customers, your CAC is $100.

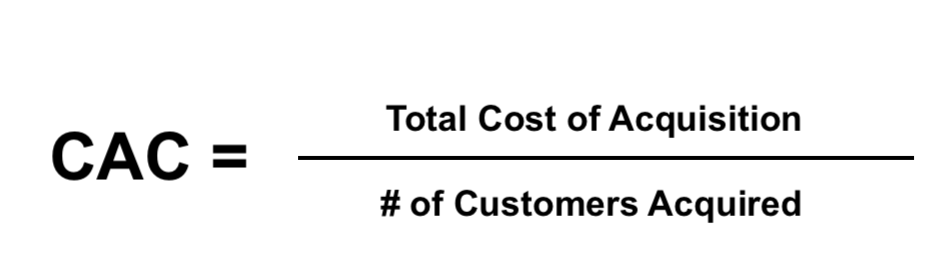

Calculating CAC is straightforward:

CAC = Total cost of acquisition / Number of customers acquired

Why (CAC) Customer Acquisition Cost Matters

This metric is an indicator for your business’s financial health in following ways:

- Budget Allocation:

- Understanding your CAC allows for a more informed budget allocation towards marketing and sales. It pinpoints where your dollars are best spent to attract new customers, ensuring a better return on investment (ROI).

- Profitability Analysis:

- Comparing CAC with the Lifetime Value (LTV) of your customers provides a window into your business’s profitability. A lower CAC and higher LTV are indicative of a healthy business model.

- Investor Attraction:

- Investors scrutinize the CAC to gauge the scalability and sustainability of your business model. A lower CAC is often seen as a positive indicator of efficient marketing and operational scalability.

- Competitive Edge:

- In a competitive market, having a lower CAC can provide a significant edge. It means you can acquire customers more efficiently than your competitors, which is crucial for market dominance.

- Resource Optimization:

- Analyzing CAC helps in optimizing resource allocation, ensuring that your marketing and sales teams are functioning efficiently.

Implementing strategies to reduce your CAC can propel your business towards profitable growth. These could include optimizing your advertising campaigns, refining your sales processes, and leveraging organic channels like SEO and content marketing.

Your CAC isn’t just a number but a reflection of your business’s operational efficiency and a roadmap to profitable growth. It’s not about merely acquiring customers but acquiring them cost-effectively to ensure a long-term success.

Incorporating CAC analysis into your business strategy is not an option but a necessity in today’s competitive market landscape. So, take the reins and steer your business towards a more lucrative future by understanding and optimizing your Customer Acquisition Cost.